Gold Royalty Receives Initial Royalty Payments on Newmont’s Producing Borden Mine

Vancouver, British Columbia – July 5, 2022 - Gold Royalty Corp. (“Gold Royalty” or the “Company”) (NYSE American: GROY) is pleased to announce that it has begun to receive royalty payments related to its Borden Lake net smelter return (“NSR”) royalty (the “Royalty”) over Newmont Corporation’s (“Newmont”) producing Borden Mine located in Ontario, Canada. Ely Gold Royalties Inc, a wholly owned subsidiary of Gold Royalty, originally purchased the Royalty on May 6, 2020. The Royalty included a five (5) kilometer area of interest (“AOI”) with a 0.50% NSR (the “AOI Royalty”) on certain claims within the AOI (the “AOI Claims”). (See Ely Gold press release dated May 28, 2020)

It has now been confirmed that mining at the Borden Mine (“Borden” or “Borden Mine”) is occurring on the AOI Claims and therefore Newmont has begun making royalty payments under the AOI Royalty. Gold Royalty has received approximately $1.4 million in royalty back payments. The AOI Royalty has been registered on the mining licence with the Ministry of Mining in Ontario.

David Garofalo, Chairman and CEO of Gold Royalty commented: “Borden brings another high-quality cash flowing asset into our portfolio. Along with the expected start of production at Beaufor this month, we will have eight royalties on producing assets and twenty assets in development supporting our industry leading revenue growth profile. As the former CEO of Goldcorp, I recall our team developing Borden as a next generation, environmentally friendly mine, and I am excited for Gold Royalty to now be a part of this asset as a royalty holder.”

The Borden Mine

The Borden Mine is operated by Newmont near Chapleau, Ontario as part of the larger Porcupine complex near Timmins. Described on Ontario’s Invest Ontario website as the “mine of the future”, Borden features state-of-the-art health and safety controls, digital mining technologies and processes, and low-carbon energy vehicles. In addition, Borden’s all-electric underground fleet eliminates diesel particulate matter from the underground environment and lowers greenhouse gas emissions. This helps to reduce energy costs, protect employee health and minimize impacts to the environment.

Newmont commenced production at Borden in late 2019 and the initial mine plan outlined a seven-year mine life extending to 2027 projecting over 100,000 ounces of annual production. Production from Borden was 521,086 tonnes grading 6.67 g/t Au at 93.7% recovery for 104,648 ounces of gold in 20201 and 588,262 tonnes grading 5.84 g/t Au at 93.76% recovery for 103,524 ounces of gold in 20212. The most recently available Mineral Reserves and Mineral Resources statement for the Borden mine was published by the project’s former owner, Goldcorp Inc., as outlined below:

Borden Gold Project Mineral Reserve and Mineral Resource Estimate3 (June 30, 2016)

- Proven and Probable Mineral Reserves of 0.95 million ounces gold (4.12 million tonnes grading 7.14 g/t gold)

- Measured and Indicated Mineral Resources of 0.56 million ounces gold (3.02 million tonnes grading 5.77 g/t gold)

- Inferred Mineral Resources of 0.41 million ounces gold (2.30 million tonnes grading 5.49 g/t gold)

Notes to Mineral Reserves and Resources:

- 2014 CIM Definition Standards were followed for the definition of Mineral Resources

- Mineral Resources are exclusive of Mineral Reserves

- Mineral Reserves were estimated using a gold price of US$1,200/oz

- Mineral Resources were estimated using a gold price of US$1,400/oz

- Quantities reported on 100% basis

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

- All figures have been rounded to reflect the relative accuracy of the estimates

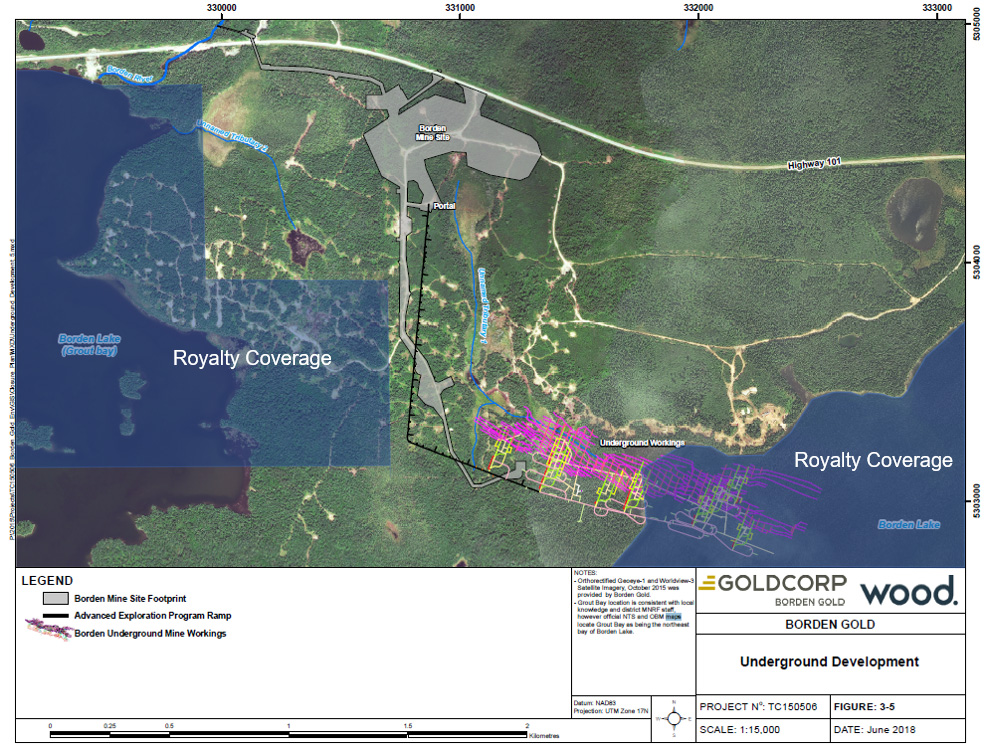

The Royalty covers several unpatented claims including a claim over the southeast portion of the Borden underground mine workings. The early years of the mine life have focused on the near surface, northwest portion of the mine, with the later years of the mine life now focused at depth, under the Company’s Royalty coverage. The Royalty also covers prospective land between one and three kilometers to the northwest of the Borden Mine. Refer to Figure 1 for the location of the Borden underground mine workings relative to the Company’s Royalty coverage.

Figure 1: Surface image taken from the Borden Mine Closure Plan Report4 showing a projection of planned mine development. Underground workings are shown extending to depth to the southeast on the Company’s Royalty. Numerous drill pads located on the Company’s Royalty can be seen to the northwest of the mine development. An overlay (dark blue) has been added to illustrate claims subject to the Royalty.

Footnotes

- Report of Activities 2020, Resident Geologist Program, Timmins Regional Resident Geologist Report: Timmins and Sault Ste. Marie Districts; Ontario Geological Survey, Open File Report 6374, 114p

- Report of Activities 2021, Resident Geologist Program, Timmins Regional Resident Geologist Report: Timmins and Sault Ste. Marie Districts; Ontario Geological Survey, Open File Report 6384, 151p.

- Borden Mineral Reserves and Mineral Resources as disclosed in Goldcorp Inc.’s 2016 Annual Report. Note that production commenced at Borden in 2019 and the 2016 Mineral Reserves and Resources Statement does not capture subsequent depletion from mining nor exploration additions. Newmont currently consolidates reporting for Porcupine which includes Borden.

- Closure Plan for the Borden Gold Mine Production Phase, 2018, Ministry of Energy, Northern Development and Mines

Qualified Person

Alastair Still, P.Geo., Director of Technical Services of the Company, is a "qualified person" as such term is defined under National Instrument 43-101, and has reviewed and approved the technical information disclosed in this news release.

About Gold Royalty Corp.

Gold Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission is to acquire royalties, streams and similar interests at varying stages of the mine life cycle to build a balanced portfolio offering near, medium and longer-term attractive returns for its investors. Gold Royalty's diversified portfolio currently consists primarily of net smelter return royalties on gold properties located in the Americas.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release relating to Borden has been derived from the Goldcorp 2016 Annual Report and other public information disclosed by the operator and has not been independently verified by the Company. Specifically, Gold Royalty has limited, if any, access to the property subject to the royalty. Although Gold Royalty does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. The Royalty does not cover the entire project area for Borden, or the areas covered by existing Mineral Reserve and Mineral Resource estimates.

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this press

release, including any references to Mineral Resources or Mineral Reserves, was prepared by the operator in accordance with Canadian National Instrument 43-101, which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC”) applicable to U.S. domestic issuers. Accordingly, the scientific and technical information contained or referenced in this press release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

For additional information, please contact:

Gold Royalty Corp.

Telephone: (833) 396-3066

Email: [email protected]

Cautionary Statement on Forward-Looking Information:

Certain of the information contained in this news release constitutes 'forward-looking information' and ‘forward-looking statements’ within the meaning of applicable Canadian and U.S. securities laws ("forward-looking statements"), including but not limited to statements regarding expectations regarding Borden and expected production at the Beaufor Mine. Such statements can be generally identified by the use of terms such as "may", "will", "expect", "intend", "believe", "plans", "anticipate" or similar terms. Forward-looking statements are based upon certain assumptions and other important factors, including assumptions of management regarding the accuracy of the disclosure of the operators of the projects underlying the Company's projects, their ability to achieve disclosed plans and targets, macroeconomic conditions and commodity prices. Forward-looking statements are subject to a number of risks, uncertainties and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking statements including, among others, any inability of the operators to execute proposed plans, risks related to exploration, development, permitting, infrastructure, operating or technical difficulties on any such projects, the influence of macroeconomic developments, the impact of, and response of relevant governments to, COVID-19 and the effectiveness of such responses, the ability of the Company to carry out its growth plans and other factors set forth in the Company's publicly filed documents under its profiles at www.sedar.com and www.sec.gov, including its Annual Report on Form 20-F for the year ended September 30, 2021. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.